What is an Education Loan?

Generally, student loans or education loans are advances provided by banks or financial institutions to assist students in paying their higher education expenses. Through this special loan Programme, students from the country who possess excellent academic credentials are offered financial assistance to study in renowned universities in India and abroad.

To assist students with their educational objectives, the Central Government facilitates Education Loan through 27 nationalized banks. Student loan documentation is kept to a minimum in order to facilitate quick loan disbursement without any delay.

One of India’s most valuable assets is its young population and their intellectual resources. Financial institutions provide student loans based on Government guidelines. Different banks have different eligibility requirements, interest rates, and repayment options. Students who have excellent academic records and do not have the financial means to continue their studies due to the financial circumstances of their family may apply for a loan. In the event of a loan approval, the financial institution guarantees the disbursement of the loan. However, you should prepare to study hard and work hard in order to repay the loan.

Applying for an Education Loan: Things to Consider

Due to the steep rise in education costs, educational loans have become an essential part of many people’s lives. Loans for education can be obtained by people who are interested in pursuing higher education. These are particularly useful if you plan to take expensive courses at a premier institution. Parents can send their children to higher education institutions with education loans. Additionally, the students can pay for their own education by repaying the education loan. Students can pay back the loans with the wages they receive from their jobs. The problem with student loans is that they can become a significant burden if not handled properly. The tips below can help you manage your loans and your further studies with ease.

Select your Course wisely:

You should not take out a personal loan for education just to go abroad. Choose a career that interests you, then turn it into a profession. The most important thing is to choose something you will excel at, regardless of what the world is doing. A student may not keep up if forced to study computers. They may not be interested. The same student could have become a great doctor if he had been interested in a medical career, leading to a wonderful career and life. Researching your passion is a good way to determine a course of study you want to pursue. Upon the completion of your course, consider what career options you have and whether you might be able to find a job. To decide all of these things, a lot of research is needed. You will not be disappointed if you do your homework properly.

Be careful when choosing your institution:

Getting to know the institution before you apply for a course is of the utmost importance. It may be the case that some universities have a good reputation but lack a sound placement strategy. Applying for courses abroad requires choosing the right institution. In many instances, students were asked to leave the country or were denied permission to fly to the United States. According to them, the reason for this was the fact that the university they selected was being investigated or blacklisted. Avoid choosing a university from a list of blacklisted universities to save time and money. They are under scrutiny because they admit students without academic qualifications to make money from their high tuition fees.

Self-application or taking the help of an overseas consultancy:

The process of applying on your own is complex. There are a lot of steps you need to follow. In addition, you will also have to do extensive research and apply for a loan to various colleges yourself. You will have to approach the bank by yourself and find out what kind of loans you qualify for. There is no need to worry about details if you choose to go through a consultancy company. They will handle a lot of the details for you and assist you. Whatever option you choose, please make sure you take the time to learn about the laws and requirements of the country you are considering for higher studies. Every detail is researched by a wise student, including how able the professors are, the reputation of the institution, course details, the loan amount and its terms & conditions, placement after the completion of the course, etc.

Selecting the right Bank:

There are several banks in India and abroad that offer educational loans for a variety of courses. Choose a bank with a reasonable moratorium period, an attractive interest rate, and a reasonable repayment amount. Furthermore, ensure you’ll be able to pay the loan off early if you decide to do so. The best bank is the one that gives the best loan terms, not the one that offers the best financing. Moreover, you should also check if you can make part payments towards the loan or if you can pay EMIs in advance. It would be prudent to find out all the charges associated with the loan you intend to take out. There might be a fee associated with prepayments and part-payments. You need to find out about these things in advance before getting the loan amount in your account.

Make sure you know these essentials:

Irrespective of whether you study in India or abroad, you should know the details of your further studies and your loans. It is necessary to obtain a VISA to enter another country, but it does not give you access to everything in that country. There may be a need for you to undergo an airport interview. This interview will determine the purpose of your trip and how you intend to enter the country. Students should prepare to answer any questions officials may ask once they get to the host country. Questions may relate to the course, the institution, the professors, the cost of the course, the amount of the loan, the repayment schedule, the interest rates, etc. You should also know your own personal details and the details of your family, such as date of birth, residence, professional qualifications, employment, etc. Prepare yourself and answer the questions honestly and confidently.

Decide your loan duration wisely:

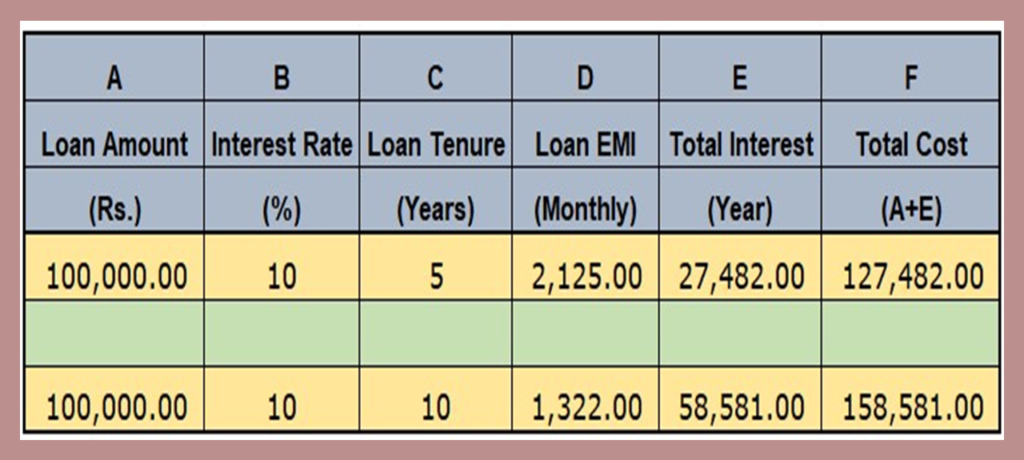

It can be tempting for some people to take out a loan for a longer duration, as this would mean a lower EMI. But the total cost of this loan and the amount paid in the form of interest will be much higher in this case. Taking a look at the below-given image, you can see that the loan taken for a longer period of time attracts a higher amount of interest, thus ultimately becoming more costly. On top of that, you can also check this calculation with the help of the EMI calculator on this website as well. As such, you may opt for a shorter loan tenure if you have a good chance of finding a well-paying job upon completing the course. Even though the EMI will be higher, your loan will still be cheaper, and you will also be able to repay it more rapidly.

Take advantage of the Moratorium period:

This is a period of time which is usually one year after the completion of the course, or six months after becoming employed, plus the course duration. We technically call this period the Moratorium period. You do not require to make any payments during this period on your loan. Your loan will accrue interest throughout this period. However, if you want can pay off the interest during this moratorium period. As a result of this, you will reduce the burden of the loan and the cost of the loan when it comes time to actually start paying your EMIs.

Get the loan amount at the time of paying the fees:

As a matter of fact, banks charge interest on the money they disburse. Generally, you have to pay for the course every semester or yearly, depending on the length of the course. As a wiser move, the bank should disburse the loan amount to you in installments. Make sure the bank will disburse the money when you will be paying your fees. If it happens this way, the accumulated interest will be drastically reduced. If you are applying for a loan, it is important to make it very clear to the bank that you will be taking the amount as per your requirement rather than one lump sum amount at the outset.

Planning for repaying the loan:

It is extremely important to make a sound financial plan when you have a loan in your name. It is important to strategize so that you are able to repay the loan once you start earning. Paying back your loan within a short duration means cutting back on the least essential things and focusing on repaying the loan as soon as you possibly can. In the long run, loans become burdensome, and therefore it would be best to settle your debts before it becomes too late for you. You need to make part of the loan payment from extra money or bonuses in order to put a dent in your loan. You will save a lot of money on interest by paying parts of the loan at times.

Tax advantage on interest:

According to Section 80E of the Income Tax Act of 1961, you can take advantage of tax benefits for the interest you pay on your educational loan. To receive a deduction under this category, you must obtain your loan from a scheduled bank or an authorized institution. Generally, you may claim tax deductions only for the first assessment year and the seven following years or until you have repaid all the interest components, whichever comes first. Consequently, the maximum tax deduction period will therefore be eight years. In view of this, the decision for a longer loan would mean that you will receive the tax benefit for only the first eight years of the loan.

Defaults due to genuine reasons are acceptable:

In the event that you are unable to land a job for genuine reasons, your bank will understand the situation. In an exceptional and true case, banks may extend your repayments or moratorium period, even if it is hard to convince them. If you are unable to complete your course on time for any reason outside of your control, the bank may extend your repayment period. Banking institutions will only consider alternative options in rare and exceptional circumstances. Always make sure you repay your educational loan on time. A failure to comply with this provision will prevent you and your co-borrower from receiving credit in the future. In the event you cannot repay the loan, the collateral you offered will also be at risk. Therefore, you need to research and plan properly before taking out a loan in order to be able to return it.

Concluding Thoughts:

As a final tip, if you are preparing to study further, make sure to have a clear plan in view, but with scope for some flexibility in your schedule. Having a fool-proof plan is not possible because the world can surprise us with many curveballs along the way. In order to make the right decision, you must first know the implications of taking out a loan to fund your education. You should also prepare yourself to cope with both the positive and negative consequences. In this way, you can manage your educational loan without much stress and pay it back without much trouble.

Key Takeaways:

1. The purpose of an education loan is to finance post-secondary education or higher education expenses.

2. The goal of education loans is to help the borrower pay for tuition, books, and supplies while pursuing a higher education degree.

3. Students often postpone payments while in college, and, depending on the lender, sometimes the deferment continues for six months after earning a degree.

4. Even though education loans come in many varieties, there are generally two basic types. Loans from public banks and loans from private banks or individuals.

[WPSM_AC id=315]

Below are some links that may be of interest to you:

[wptb id=752]