What is a Gold Loan?

Gold Loans are loans secured by gold jewellery, in which the customer deposits gold jewellery as security with the Gold Loan provider. Upon receiving the gold, the company grants the customer an amount based on its current market value.

In India, taking on a Gold Loan is quite easy and secure, and has been a practice for decades. It is not uncommon for people to pledge gold ornaments as collateral to get funding to cover a huge expense or even to launch a new business. Banks and non-banking financial companies (NBFCs) offer gold loans.

A gold loan is a secured financial debt where gold jewellery serves as collateral. At the time of the loan application, the gold market rate is used to calculate the gold’s market price per gram. The calculation considers only the value of the gold parts of the jewellery. It excludes all other metals, stones, and gems from its calculation.

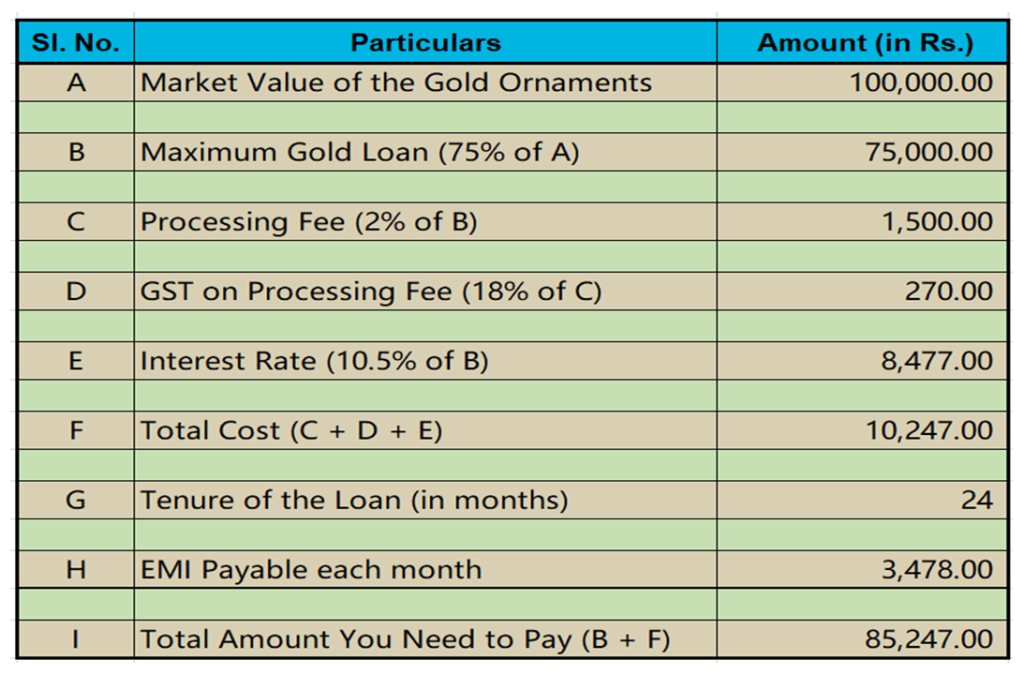

An individual borrows the amount against gold securing the gold ornaments with the lender as collateral. Lenders typically express loan amounts in terms of percentages. It may range from 60% to 75% of the gold’s value. In most cases, the repayment of the debt takes place through monthly installments. You will receive your gold back once you have repaid the borrowed amount including interest. Refer to the below data in order to get a better idea of how much you are going to pay if you pledge one lakh worth of Gold with a lender.

Gold Loan is the best option for short-term credit needs. For example, financial assistance for a family wedding, a medical emergency, or a child’s education. It is better to borrow money by pledging your gold ornaments rather than selling your jewellery. Therefore, we can conclude that you should take a Gold Loan instead of selling your jewellery if needed.

In response to the economic impact of the pandemic, the World Gold Council said gold loans have been in high demand through both banks and non-banking financial companies.

A Gold Loan offers the following Key Features:

Purpose of Gold Loan:

There are a number of reasons why you may want to take out a gold loan. For instance, it could be to finance educational expenses, wedding expenses, go on a holiday, pay for medical emergencies, etc.

Pledged Gold acts as a Security:

There is a significant amount of gold pledged with the bank or financial institution. This gold acts as a guarantee against which the loan amount can be provided.

Gold Loan Tenure:

As compared to many other loans, the repayment period for gold loans tends to be relatively shorter. Typically, the tenure of any Gold Loan falls between a long-term (maximum 24 months) and a short-term (minimum 6 months). It should be noted that long-term loans are usually repaid in installments, while short-term loans are usually repaid as a lump sum.

- Long-term Gold Loan – In the case of a monthly installment loan, you could repay the loan in up to 24 installments per year if you choose monthly payments. Basically, this means that the entire tenure of the Gold Loan is 24 months. However, even if you choose a shorter loan repayment period, such as 12 months, you will still be able to repay your loan before the end date. As long as you pay at least three installments, the banks do not impose any prepayment charges if you close the loan before the term you choose.

- Short-term Gold Loan – The maximum tenure for repaying a Gold Loan during the short Gold Loan tenure is 6 months at a fixed interest rate, which is the maximum repayment term. After the loan tenure has ended, you have the option of repaying the entire loan in a single lump sum. Prepayment penalties are not applicable on this type of loan, as well, if you pay back the loan before the six months are up.

Options for Repayment of Gold Loan:

There are 4 different options available for a borrower to repay back the Gold Loan. Let us look into these four options:

- Pay Interest as EMI & Principal later: Gold loans are repaid using this method, where you repay interest due according to the EMI schedule given to you by the lender. The principal can be paid off with one single payment, however. At the maturity of the loan, you can make only a single payment. The reason borrowers prefer these methods of repayment is that they can repay only the interest amount without worrying about paying the principal as well.

- Make Partial Payments: With this type of gold loan repayment, you do not have to adhere to the EMI schedule set by the lender. You can pay interest and principal in partial installments as and when you wish. You can also customize your repayment schedule according to your financial situation. Choosing to pay off your principal at the beginning reduces your daily interest payments. Interest calculation depends on the loan amount that remains outstanding. As a result, you save a considerable amount on the serviceable interest.

- Bullet Repayment: As part of the bullet repayment plan, you must pay both interest and principal at the end of the loan’s tenure. During the loan tenure, you will never have to worry about paying back the Gold Loan. When the loan tenure ends, you can simply make the entire payment without having to adhere to any EMI schedule. Each month, interest is accumulated but not due until the Gold Loan term is over. Known as a bullet repayment plan because it entails one payment, this form of gold loan repayment requires one payment.

- Regular EMI Option: EMI-based gold loan repayments are ideal for salaried individuals with a fixed monthly income. The outstanding EMI amount for repayment includes both interest and principal amounts. Since this loan is favorable to salaried individuals, it is approved faster.

Different Charges Associated with a Gold Loan:

It is possible to impose a number of other fees in addition to the interest rate. These could include processing fees, documentation fees, appraiser fees, late payment fees, and overdue loan fees. Cumulatively, these charges can raise the total cost of the loan. You should therefore be aware of the charges levied by the lender before applying for a gold loan.

Factors Influencing Gold Loan Interest Rates:

- Market price of gold – In the event that gold’s price is high in the market, the value of the gold ornaments or coins that you are pledging will also be high. When such a scenario occurs, the lender will offer you a lower interest rate since the risk involved is relatively low. By selling/auctioning off the gold ornaments, the lender can easily recover the outstanding amount owed to the lender. As the gold market price is high so he will be able to get a good price for the pledged gold. You may find yourself in this situation if you are unable to pay back the loan amount.

- The inflation rates – A high inflation rate would mean that the value of a currency would depreciate. As such, people would tend to accumulate more gold in their possession. When inflationary conditions persist for a longer period of time, gold can act as a hedge against such conditions. This pushes the gold price higher as a consequence. In this scenario, if you apply for a gold loan, you might qualify for lower interest rates.

- Relations with the bank – The vast majority of banks provide gold loans to their existing customers without much documentation. But individuals without an established relationship with a bank may be able to apply for a gold loan as well. Additionally, existing customers of lending institutions tend to negotiate lower interest rates than new ones.

[WPSM_AC id=321]

Below are some links that may be of interest to you:

[wptb id=752]